A low DSO means that customers are paying promptly after receiving their invoices and that your team is quickly processing the payments. This correlates to good cash flow and lower amounts of bad debt write-offs. The Accounts Receivable cycle includes steps from order placement and approval to invoicing and collection, finishing with payment processing and reporting. It also includes steps for addressing bad debts and disputes if the customer should challenge their bill or refuse to pay.

Great! The Financial Professional Will Get Back To You Soon.

In this case, you’d debit “allowance for uncollectible accounts” for $500 to decrease it by $500. Many companies will stop delivering services or goods to a customer if they have bills that are more than 120, 90, or even 60 days due. Cutting a customer off in this way can signal that you’re serious about getting paid. You (or your bookkeeper) record it as an account receivable on your end, because it represents money you will receive from someone else. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Jami Gong is a Chartered Professional Account and Financial System Consultant.

How accounts receivable automation software can help improve your A/R workflow

The accounting staff should reconcile the two as part of the period-end closing process. An A/R aging report (sometimes called an “A/R aging schedule”) records all of the outstanding payments that are still due to your business from your customers. At a glance, you can track not only the individual promptness of each of your customers but also gain a thorough understanding of how smoothly your A/R operations are going.

How confident are you in your long term financial plan?

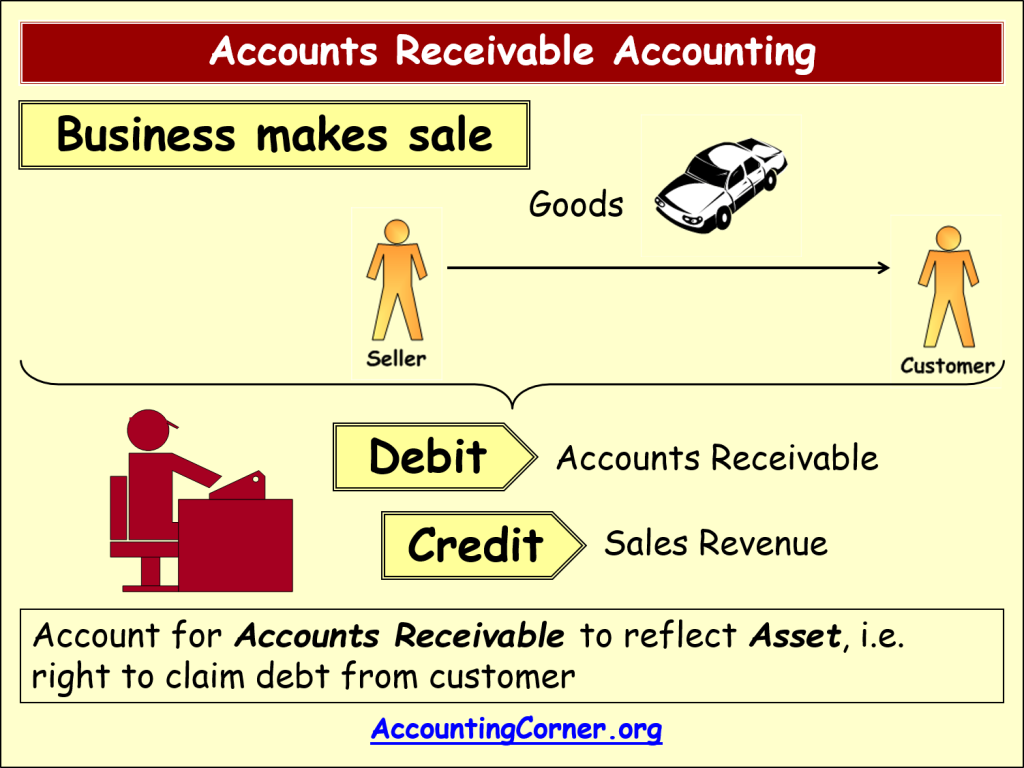

Under accrual accounting, the accounts receivable line item, often abbreviated as “A/R”, refers to payments not yet received by customers that paid using credit rather than cash. The accounts receivable aging report breaks down your outstanding invoices by how old they are. To create this report, you’ll group your accounts receivable balances by the age of each invoice. Accounts payable is a current liability on the balance sheet, while accounts receivable is a current asset. When you have a system to manage your working capital, you can stay ahead of issues like these. Calculating your business’s accounts receivable turnover ratio is one of the best ways to keep track of late payments and make sure they aren’t getting out of hand.

Would you prefer to work with a financial professional remotely or in-person?

- Some businesses will create an accounts receivable aging schedule to solve this problem.

- Any measure that your business takes to monitor or capture the revenue from credit-based purchases will require technology and personnel—resources that you have to pay for.

- The 8 steps outlined below provide a foundation for creating a simple and effective Accounts Receivable process.

- It will be reported in two separate assets, current assets and non-current assets.

The term refers to accounts a business has the right receive because of goods and services delivered. In this journal entry, there is no impact on the total assets of the balance sheet as it increases one asset (cash) and at the same time, decreases another asset (accounts receivable) by $200. Keeping track of exactly who’s behind on which payments can get tricky if you have many different customers.

Emailing invoices, and providing an online payment option, encourages customers to pay immediately, which speeds up the cash collections. Best of all, invoice automation makes the buying process should taxes on stock influence your decision to buy or sell easier, and improves the customer’s experience with your company. Accounts receivable is the amount owed to a company resulting from the company providing goods and/or services on credit.

Likewise, the company can make the accounts receivable journal entry by debiting the accounts receivable and crediting the sales revenue account. With accounting software like QuickBooks, you can access an aging report for accounts receivable in just a few clicks. You’ll want to monitor this report and implement a collections process for emailing and calling clients who fall behind. This ratio tells you how many times you’re collecting your average accounts receivable balance.

Notes have a specific definition under GAAP but for the most part, this will be an IOU from one company to another that may or may not get paid off in time. In any event, any contingent liability arising from discounted notes treated as sales should be disclosed in the notes to the financial statements. J. C. Penney’s annual report provides a good example of how receivables are presented in corporate financial statements. It is included in either the long-term investment or other asset section of the balance sheet. Other types of transactions may create receivables, such as payments of advances and deposits, or filing for tax refunds.