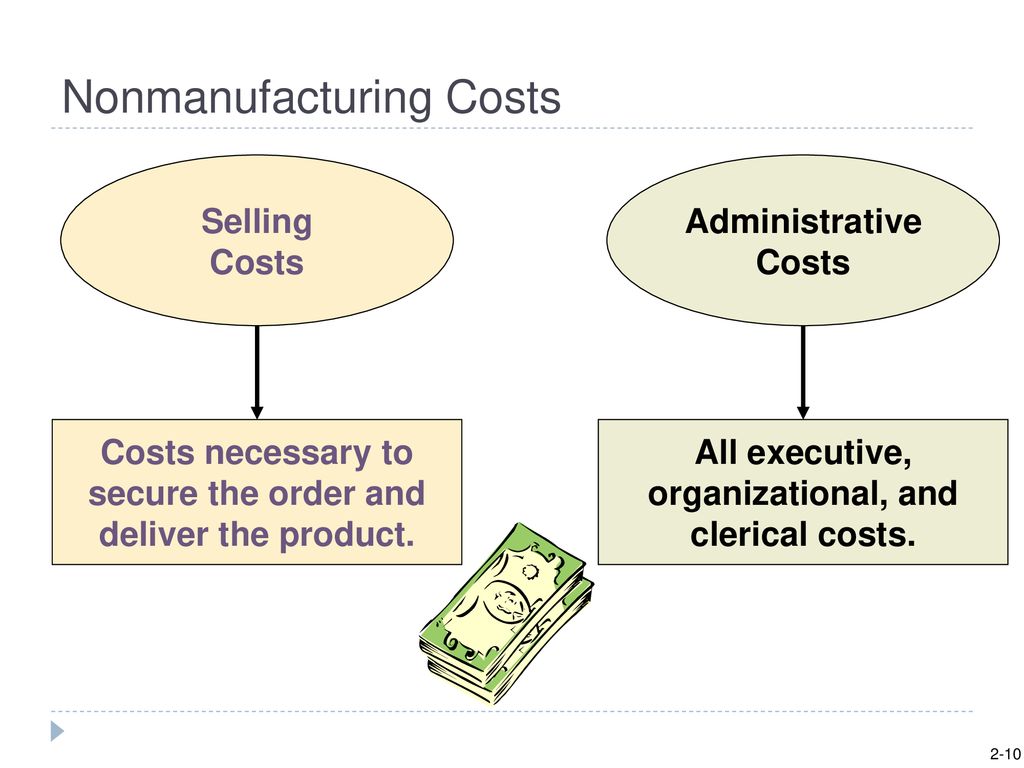

However, if management wants to determine the profitability of a specific product or customer, it is necessary to allocate or assign nonmanufacturing costs to the products and/or customers outside of the financial statements. In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit. Selling expenses are costs incurred to obtain customer orders and get the finished product in the customers’ possession. Advertising, market research, sales salaries and commissions, and delivery and storage of finished goods are selling costs.

Manufacturing Overhead Outline

A manufacturing entity incurs a plethora of costs while running its business. While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability. Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis. Direct labor – cost of labor expended directly upon the materials to transform them into finished goods.

How to calculate total manufacturing cost?

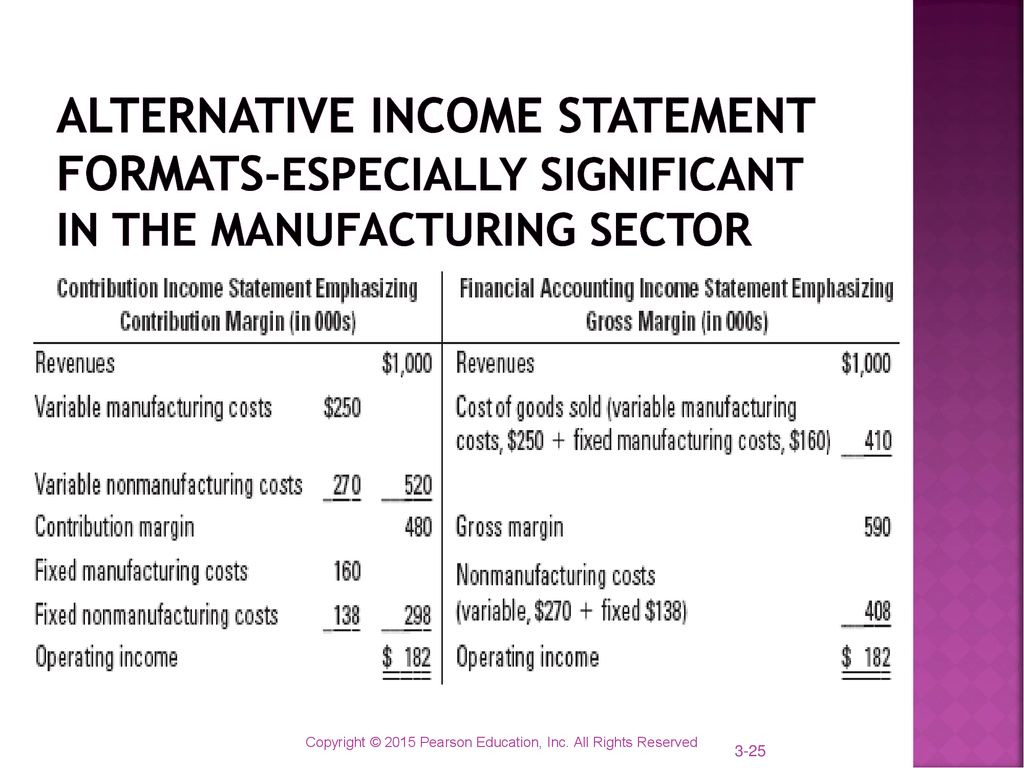

Manufacturing costs initially form part of product inventory and are expensed out as cost of goods sold only when the inventory is sold out. Non-manufacturing costs, on the other hand, never get included in inventory rather are expensed out immediately as incurred. This is why the manufacturing costs are often termed as product costs and non-manufacturing costs are often termed as period costs. Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform. Examples of indirect materials (part of manufacturing overhead) include glue, paint, and screws. Direct labor includes the production workers who assemble the boats and test them before they are shipped out.

- These fringe benefit costs can significantly increase the direct labor hourly wage rate.

- For instance, if the manufacturing costs are too high, these costs can create a dent in the company’s profit.

- Understanding non-manufacturing costs is essential for effective budgeting and financial planning as they impact overall profitability and can influence pricing strategies.

Production Costs

All other manufacturing costs are classified as manufacturing overhead. All nonmanufacturing costs are not related to production and are classified as either selling costs or general and administrative costs. These costs are reported on a company’s income statement below the cost of goods sold, and are usually charged to expense as incurred. Since nonmanufacturing overhead costs are treated as period costs, they are not allocated to goods produced, as would be the case with factory overhead costs. Since they are not allocated to goods produced, these costs never appear in the cost of inventory on a firm’s balance sheet. Nonmanufacturing overhead costs are the business expenses that are outside of a company’s manufacturing operations.

The materials that are yet to be assembled /processed and sold are considered work-in-process or work-in-progress (WIP) inventory. Manufacturing costs are recorded as assets (or inventory) in the company’s balance sheet until the finished goods are sold. Another commonly used term for manufacturing costs is product costs, which also refer to the costs of manufacturing a product. Calculating manufacturing costs helps assess whether producing the product is going to be profitable for the company given the existing pricing strategy. Cost control, according to Fabrizi, is one of the top benefits of calculating manufacturing costs.

Direct labor refers to salaries and wages of employees who work to convert the raw materials to finished goods. Direct materials – cost of items that form an integral part of the finished product. Examples include wood in furniture, steel in automobile, water in bottled drink, fabric in shirt, etc. “When a manufacturer begins the production process, the costs incurred to create the products are initially recorded as assets in the form of WIP inventory. A balance sheet is one of the financial statements that gives a view of the company’s financial position, while assets are the resources a company owns.

Each of them requires a different set of cost control measures, making appropriate cost categorization even more essential. For instance, if the manufacturing costs are too high, these costs can can freshbooks do taxes create a dent in the company’s profit. In this case, the management can decide to stop the production of some goods and invest in developing new ones that have a lower cost of production.

We use the term nonmanufacturing overhead costs or nonmanufacturing costs to mean the Selling, General & Administrative (SG&A) expenses and Interest Expense. Under generally accepted accounting principles (GAAP), these expenses are not product costs. (Product costs only include direct material, direct labor, and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred.