Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities. It reflects the company’s ability to generate income from its core operations, indicating its financial health and growth potential. As mentioned above, equity is one of the so-called balance sheet accounts, as it appears in the balance sheet. Equity is listed alongside liabilities, representing the shareholders’ stake in the company’s assets. The total equity amount reflects the company’s net worth or book value, which is the value of the assets minus the liabilities. The standard chart of accounts requires you to present your finances divided into several groups – accounts – representing various aspects of your business activities.

Tip 2: Align business units

Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances. Of course, your particular industry will also determine how you customize your COA. While account identifier categories for the tangible costs of wells and development make sense for an upstream oil and gas company’s COA, they’d obviously be irrelevant for a chain of bakeries. A small business will likely have fewer transactions and accounts than a larger one, meaning a three-digit system of identification codes might suffice. Even worse, if your competition has a highly efficient and streamlined COA, they will always have a competitive advantage over you.

Liability accounts

The COA also includes accounts for online payment systems to monitor digital transactions. A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger. It provides you with a birds eye view of every area of your business that spends or makes money. The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company.

Financial Statement

- Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system.

- To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts.

- HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces.

- When a company purchases inventory on credit, the Inventory account is debited to increase it, and the Accounts Payable account is credited to record the liability to pay for the inventory in the future.

Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity. Separating Other Comprehensive Income allows businesses to track changes in the components of an internal control system value of certain assets or liabilities over time. Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

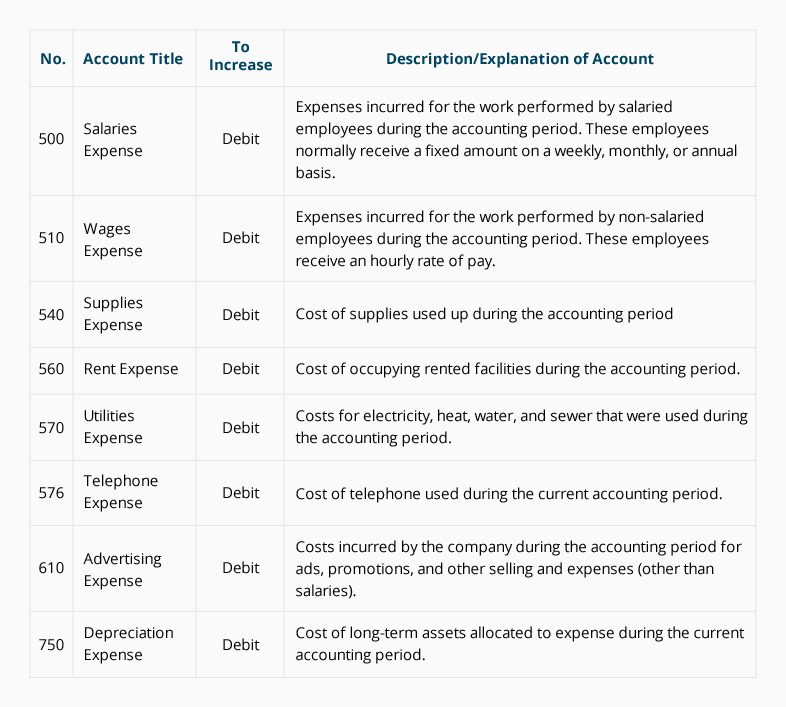

Also, it’s important to periodically look through the chart and consolidate duplicate accounts. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts. With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. To help illustrate the types of accounts that can be included in a chart of accounts, here are some common examples categorized by type.

Sign up for latest finance stories

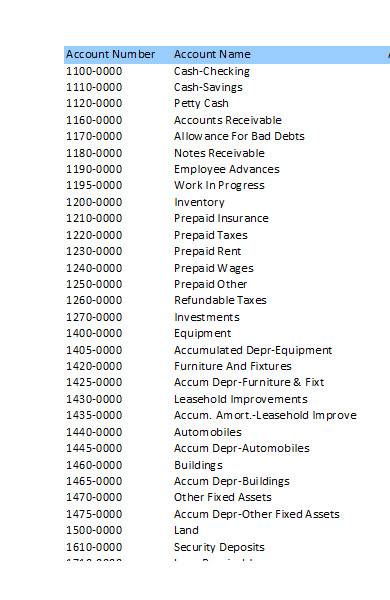

When allocating account codes (chart of accounts numbers) don’t forget to leave space for additional accounts and codes to be inserted in a group at a later stage. For example the inventory codes run from 400 to 499 so there is plenty of room to incorporate new categories of inventory if needed. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions.

While Pacioli’s work laid the foundation for modern accounting, a standardized chart of accounts had yet to emerge. The COA, in this case, might include revenue accounts like Service fees and Consulting revenue to track earnings. An expense account named Professional fees can be added to monitor costs for hiring professionals. Marketing expenses is another expense account to track promotional costs.

In this sample chart of accounts numbering system, the company breaks its cost of goods sold (COGS) off into its own account name and number group, allowing it to categorize transactions with greater detail. Thus, an identifier like might signify a COGS transaction (the first digit) from sales division #4 (the second digit) and product line #120 (the final three digits). As a slight aside, it’s also important to keep in mind the relationship between your COA, GL, and financial statements.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The most important component when working with a chart of accounts is consistency, which enables the comparison of financials across multiple accounting periods and business units. Today, the chart of accounts is an integral element of accounting software, and its use is widespread across various industries and organizations. Accounting software can facilitate standardization, providing pre-defined templates that align with generally accepted accounting principles (GAAP).

It works as a guide to all the components a business employs to categorize and log financial activities within its accounting framework. The chart of accounts helps you organize your transactions into a convenient view of how the money moves through your business. Yes, it is a good idea to customize your chart of accounts to suit your unique business. An added bonus of having a properly organized chart of accounts is that it simplifies tax season.

A COA breaks down your transactions during a particular accounting period into specific account categories, helping people quickly gain clear insights into your organization’s financial health. The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded. Journal entries, on the other hand, are the script— the actual recording of financial transactions as they occur.